When we talk about bookkeeping and accounting, it is hard to tell any difference between each. While both processes share common goals, they work for your business in different stages.

Despite common similarities and roles, the world of bookkeeping and accounting are apart. Bookkeeping is more administrative and transactional, related to recording financial transactions. Whereas the main job of the accountant is to interpret this data based on bookkeeping information.

In this informative post, we will describe the functional differences, their roles to help you understand which one is appropriate for your company.

Bookkeeping Responsibilities: Functions

Bookkeeping means recording daily transactions accurately and is very important to build a successful company.

It is comprised of:

- Posting debits & credits.

- Recording financial transactions.

- Maintaining and balancing subsidiaries.

- Maintaining general ledgers.

- Checking historical accounts.

- Producing invoices.

- Completing payroll.

General ledger maintenance is the major task of bookkeeping. It is a document where you have to record the sales and expenses amount.

It means posting, when a sale is completed, a ledger is posted. A ledger can be easily produced on paper, with the help of a computer spreadsheet or any specialized software.

The complications of bookkeeping depending on the business size and transaction numbers that are performed daily. All sales and purchases are recorded in the ledger. Here, many items require documents that have to match with the IRS guidelines.

Accounting Responsibilities: Functions

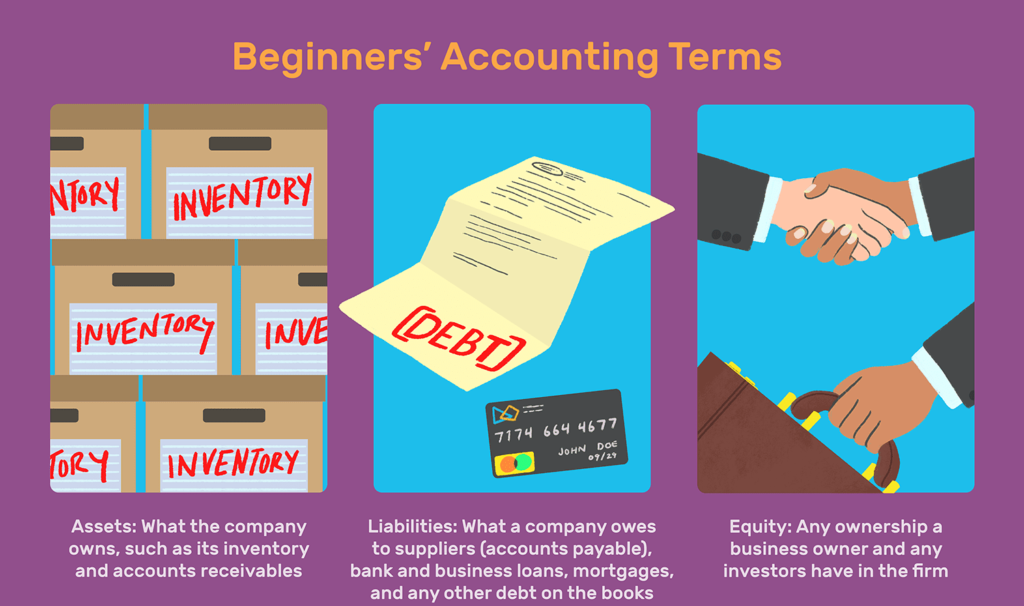

It is a process that is performed on a high level to perform business-related tasks. It uses the information gathered by a bookkeeper and then produces financial models with the help of that information. This process is more subjective than the first one which is majorly transactional.

It contains:

- Preparing financial statements of the company.

- Make adjusting entries.

- Completing tax returns.

- Analyzing operations costs.

- Aiding the company owner to inform him/her about the impact of financial choices.

The accounting process provides reports to bring important financial indicators together. This helps in understanding the actual profitability properly, and become aware of cash flow in it.

Accounting changes the ledger information into statements which helps in revealing the bigger picture of the company. The owners also come to accountants to assist with strategic financial forecasting, tax planning, and filing.

The Accountant Role vs Bookkeeper Role

Sometimes Accountants and Bookkeepers do the same work. But generally, a bookkeeper’s work is to make you financially organized by recording transactions while accountants offer analysis, consultation and are considered to be more qualified to give suggestions and advice on tax matters.

Credentials of the Bookkeeper

Bookkeepers don’t have to complete any formal education. To establish themselves properly, they have to be accurate and knowledgeable in their field. Typically, the work done by bookkeepers is supervised by either the company owner whose books they are completing or an accountant. So bookkeepers are not “Accountants.”

Credentials of the Accountant

To work as an accountant, an individual should acquire a bachelor’s degree in accounting. If a person doesn’t have a degree in accounting, then he may opt for a finance degree as it acts as an adequate substitute.

Accountants can also obtain more professional certifications. For instance, accountants who have sufficient education and experience can receive the Certified Public Accountant (CPA) title. For this title, an accountant has to clear the exam of Uniform Certified Public Accountant and must possess some experience as an accountant.

Bookkeeping vs. Accounting: The Difference

Here are quick pointers to summarise the similarities and differences between the two processes.

THE SIMILARITIES:

- Both accountants, as well as bookkeepers, work with financial data.

- Both of them share a common goal of taking care of the company’s financial health.

- Sometimes, their roles get overlapped due to the invention of bookkeeping software.

- Both are tax compliant.

- Both these processes require basic accounting knowledge to excel in the fields.

DIFFERENCES

- Bookkeeper: Records and classifies the financial transitions. Accountant: Analyze, Interprets, and offer advice based on data.

- Bookkeeper: Prepares general ledger Accountant: Assesses the information from the ledger for preparing financial statements.

- Bookkeeper: Tracks income and expenses for tax seasons. Accountant: Files tax returns.

Accountant or Bookkeeper? Which One to Choose?

First of all, it is important to analyze if you need an accountant or a bookkeeper for your company. This decision depends on the industry and the required expertise.

A bookkeeper will be affordable and a better option for maintaining daily transactions, but if you want deep insight on how to operate your company better on a large scale, then you need an accountant.

Before taking any decision, here are some questions to consider:

- How big is your inventory?

- What is your industry type?

- How many employees have you employed?

Companies with high-volume transactions and tough financial systems require accountants such as colleges, government agencies, hospitals, etc.

Also Find, Best Quickbooks Hosting Services 2021 (A User Manual)

A skilled and knowledgeable with years of experience is eligible to run your company books than a new off the campus CPA.

Make sure not to judge an applicant just based on his/her qualification only. Consider these points while reviewing an applicant:

- Check expertise level, certifications.

- Services the applicant can offer.

- Experience of the individual.

To Wrap Up

Despite the blurring of roles and similarities, bookkeeping and accounting are two different professions. Numerous people often confuse these services to be the same. Hopefully, this informative article helped simplify these similarities and differences to eradicate any confusion.

We hope that now you understand how both of the occupations play different roles in the companies. You can decide now which one is better for your business. If you have any relatable query then write to us in the comments section below. We will surely get back to you with the best possible response.